Why do Mass Spectrometers cost as much as a house?

- goodgreenlife

- 2 days ago

- 9 min read

If I aim to put a mass spectrometer (MS) into every home, understanding why they cost so much is really important. I’m double checking with Waters, I’ve asked for a quote but supposedly one of the cheapest MS’s on the market is Waters RADIAN ASAP direct mass spectrometer (link) at £35,000 for the unit. After speaking to a sales rep at PURSPEC technologies, their Cell Miniature MS machine is $100,000 or £73,000 for the hardware and software (pdf). The cheapest mass spectrometer I have seen made is the quadrupole MS from the Girguis group at Havard for $15,000 or around £10,000, this was made to operate underwater to study the influence of microbes on the methane and hydrogen content of the ocean.

However, MS machine differ greatly in how they gather data and thus their hardware requirements. There are multiple mass analysers: Quadrupole, Ion Trap, Orbitrap, Time of Flight, Magnetic and Electromagnetic Analysers, Ion Cyclotron Resonance and Fourier Transform MS as well as Hybrid Instruments. As some instruments are bespoke and others common, so their price points will massively differ.

Parts of a Mass Spectrometer

The parts of a MS are inlet, ionisation device, mass analyser, detector, Vacuum and Data control. Are all parts equally expensive or do some incur more expense than others? Additionally what are the others costs that are factored into the price of a MS machine. Software, Profit, R&D, supporting functions other business operations.

You can therefore infer that the cost of goods and assembly for a company like PURSPEC technology is less than the device price. In addition I’ve learnt that the mass analysers tend to be made in house, other parts tend to be sourced from suppliers. This introduces another factor that will increase cost. If you are selling a 100 instruments a year, this is the best way to do so and is not an issue, if you are selling 100 instrument a day it very much is.

For now, I will stick with nESI (nanoelectrospray ionisation) as the ioniser. These use smaller emitter tips (typically less than 50 µm) as a preferred option for portable mass spectrometers, because nESI does not require nebulisation gas and offers improved ionisation efficiency (link).

For the mass analyser, ion traps are very common, the reason it is a popular choice is due to their small size, ability to operate at higher pressures (reducing vacuum pump size) and MS/MS capabilities.

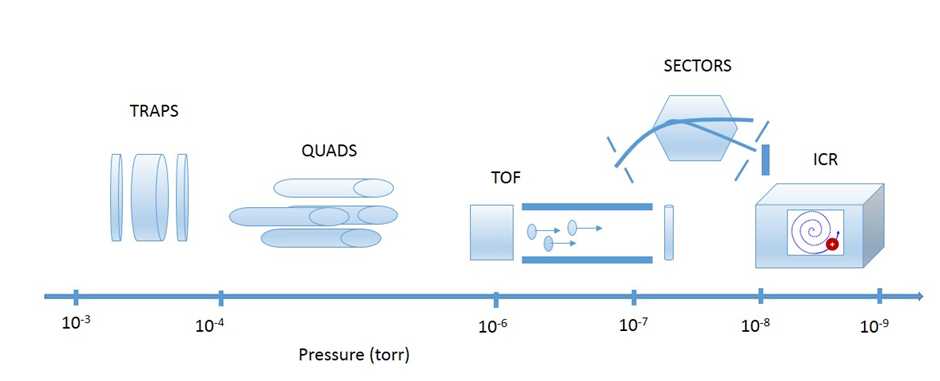

The purpose of the vacuum is to eliminate background signal and avoid intermolecular collision events, providing a longer mean free path for the ions. The vacuum system including the vacuum pumps and the vacuum manifold with its various interfaces are often the heaviest part and consumes the most power in a mass spectrometer. Different mass analysers have different mean free paths, the longer the mean free path, the greater the chance of collision so the greater the vacuum required.

By default, greater pressure means more/stronger pumps, especially to achieve vacuums of deep space (10-10 torr) used by orbitraps, 3 turbomolecular pumps may be required. This would be significantly more expensive than 1 turbomolecular pump for an ion trap or quadrupole. However vacuum technology is constantly being improved such that from Creare, Inc, their put weighs 500g and needs below 18 W power and providing a vacuum below 10-8 torr.

Percentages of parts

Regardless we can roughly estimate the percentages of each cost of a mass spectrometer. As well as assume a low margin on instruments and a much higher margin on consumables.

Cost Category | Percentage of Instrument cost |

Materials and Components | 25 – 35% |

Manufacturing and Labour (assembly, calibration, quality control) | ~10% |

R&D | 10 – 15% |

Profit / Margin | 10 - 20% |

Sales and Support | 10 - 15 % |

Corporate Overhead | 5 – 8% |

If Materials and Components, manufacturing and labour are roughly 45%, applied to the purspec technology mini mass spectrometer, it would be around $45,000 or £32,000 to actually build the device. Yes, the other business and R&D costs are completely necessary but this just shows that reducing the cost by a factor of 10 for a mini MS if difficult but not far fetched.

What is the future of production miniature mass spectrometers

“Future miniature mass spectrometers and path forward” – (link) Zheng Ouyang from Purspec technologies shared these thoughts

“The future of the miniature MS analysis systems could be very bright; the path for their commercialization, however, could still be very difficult. It is not a natural move for any of the current major instrument companies to initiate the production of small systems. No doubt they all retain top-quality instrumentation scientists who can produce products of novel capabilities; however, it can be mentally torching to ask the builders of Mercedes-Benz automobiles to shift their interests to making scooters. Besides, market research plays such an important role nowadays in deciding which products to develop, and no valid data would be available for anything truly groundbreaking. Unless a "dictator" with a vision like Steve Jobs appeared in one of the large instrument corporations, development of miniature MS products would more likely be pursued by some desperate startups that really want to go beyond the homeland security market. Even then, however, patent issues can be formidable for such small companies because technical areas are well-covered by the major players in the industry.

China, however, is uniquely positioned to assume a major role in commercializing miniature MS analysis systems. Traditionally, instrumentation companies have not applied for patent protection for their technologies in China. Therefore, it is easier to produce a product package that includes the best suitable technologies in China than to do so in North America, Europe, Japan, or Australia. Would the size of the market in China justify such a development? Indeed it would. China has become the world's number-two market for MS products. Given the high cost of materials in the production-based economy, improper use of cheap materials and illicit additives is a problem in China that calls for product quality control. This is a major application area well suited for specialized MS systems. Since 2004, the Chinese government has invested in MS product development, and the funding amount was dramatically increased recently, with each individual project funded at $10M or higher. Although the direct product outcomes of these investments remain to be seen, the development activities have certainly trained many researchers and developers in the requirements of the MS instrument industry. Because it lacks a major player in that industry, China has been striving to establish one, and the concept of small instruments for specialized applications has long been considered as a good foothold for breaking into the business of MS manufacture. Also, the culture of "wide mass range," "high dynamic ranges," and "ultimately high resolution and precision" is not so deeply rooted in China as it is in other places. Thus it would come as no surprise to soon see some miniature MS products manufactured there and packaged into different systems suitable for various needs in different global regions.”

Deep Dive: Component Costs and Supply Chains

To understand where costs can be reduced, we need to examine each subsystem in detail, including the supply chain structure and margin stacking that occurs from raw materials to end users. OEM pricing refers to the cost of components by an original equipment manufacturer to a another company for integration into their final product.

Subsystem Cost Breakdown and Vendors

This break down was provided by Claude.ai, there are no sources for this online. Estimated prices have come from vendors that have freely shared their prices, so do take this with a pinch of salt.

Subsystem | Components / Vendors | Retail Price Range | OEM Cost | Manufacturing Cost | Key Suppliers |

Vacuum System | |||||

Turbomolecular pump | Pfeiffer HiPace 10/80, Edwards nEXT series, Agilent TwisTorr | £3,000 - £6,000 | £1,500 - £3,000 | £750 - £1,200 | Pfeiffer Vacuum, Edwards Vacuum, Leybold, Agilent |

Backing pump | Pfeiffer MVP, Edwards RV, dry scroll pumps | £500 - £2,000 | £300 - £800 | £150 - £400 | Same as above |

Miniature alternatives | Creare Inc. micropump, MEMS vacuum pumps | £500 - £2,000 (emerging) | £300 - £800 | £100 - £300 | Creare Inc., various MEMS startups |

Mass Analyser | |||||

Quadrupole (commercial) | Custom manufactured, Extrel, ARDARA | £10,000 - £25,000 | £3,500 - £7,000 | £1,300 - £2,400 | Typically in-house or specialty manufacturers |

Ion trap | Custom or adapted commercial | £5,000 - £15,000 | £2,000 - £5,000 | £800 - £2,000 | Typically in-house |

Ion Source and Inlet | |||||

nESI source | Custom built, New Objective PicoTip emitters | £200 - £500 (emitters) | £100 - £250 | £50 - £150 | New Objective, custom fabrication |

Complete ion source assembly | In-house design with filaments, lenses | £2,000 - £5,000 | £800 - £1,500 | £300 - £600 | In-house assembly |

Detector | |||||

Electron multiplier (CEM) | Photonis, ETP Scientific, Detector Technology Inc., Hamamatsu | £1,500 - £3,000 (OEM) | £300 - £600 | £80 - £200 | Photonis, ETP Scientific, Detector Technology |

Aftermarket detectors | CPI International, Analytical West | £200 - £800 | N/A | Same manufacturing | Aftermarket suppliers |

Microchannel plate | Hamamatsu, Photonis | £2,000 - £5,000 | £800 - £1,500 | £300 - £600 | Hamamatsu, Photonis |

Control Electronics | |||||

RF power supply | Custom or Ardara RF generators | £1,000 - £5,000 | £500 - £1,500 | £200 - £400 | Often in-house design |

Wisconsin Oscillator (open-source) | DIY/research design | N/A | N/A | £15 - £40 | Component suppliers |

High-voltage DC supplies (×3-5) | Spellman, EMCO, XP Power | £500 - £2,000 each | £200 - £600 each | £80 - £150 each | Spellman, EMCO, XP Power, Matsusada |

Data acquisition system | National Instruments, custom FPGA | £1,000 - £3,000 | £500 - £1,000 | £200 - £400 | National Instruments, Xilinx, custom |

Integrated control board (high volume) | Custom PCB with all functions | N/A | N/A | £80 - £150 | Contract manufacturers |

Power Supply and Battery | |||||

AC/DC converter | Mean Well, TDK-Lambda | £100 - £500 | £50 - £200 | £30 - £100 | Mean Well, TDK-Lambda, CUI |

Battery pack (portable units) | LiPo/Li-ion custom packs | £300 - £1,000 | £150 - £400 | £80 - £200 | Various battery assemblers |

Mechanical Structure | |||||

Vacuum chamber | Stainless steel, custom machined | £2,000 - £5,000 | £1,000 - £2,000 | £300 - £800 | Machine shops, in-house |

Housing/enclosure | Aluminum or composite | £500 - £2,000 | £300 - £800 | £150 - £300 | Sheet metal fabricators |

Vacuum flanges | Kurt J. Lesker, Varian (KF/ISO standard) | £50 - £300 each | £30 - £150 | £20 - £80 | Kurt J. Lesker, MDC Vacuum, VAT |

Software | |||||

Control and data analysis | Custom developed | Included in price | N/A | £5,000 - £20,000 (amortized) | In-house development |

Manufacturing and Labour | |||||

Assembly | Skilled technicians, clean room | N/A | N/A | £1,500 - £3,000 per unit | In-house or contract |

Calibration and testing | Specialized equipment and expertise | N/A | N/A | £1,000 - £2,000 per unit | In-house |

Overhead and Margin | |||||

R&D (amortized) | N/A | 10-15% of retail | N/A | £3,500 - £11,000 | N/A |

Sales and support | N/A | 10-15% of retail | N/A | £3,500 - £11,000 | N/A |

Profit margin | N/A | 10-20% of retail | N/A | £3,500 - £15,000 | N/A |

For an individual unit from PERSPEC

Direct manufacturing costs ~£32,000

Component supplier margins embedded ~ £7,000

Raw manufacturing cost if vertically integrated ~£25,000 – 28,000

Vertical integration is when a company owns and controls multiple stages of its own supply chain, from raw materials to production, distribution, and sales, rather than relying on external suppliers for different steps. For example a coffee company would own farms, roasters, shops and delivery to have control over the entire production process.

Margin Stack problem

Margin stacking is the cost or profit that each member of the supply chain contributes to bring a product to the end user.

For example Pfeiffer makes turbopumps. The raw materials may cost £400, and manufacturing £800, giving a total cost of £1,200. However they would need to sell at around £2,000 to make a 40% margin. PURSPEC buys at £2,000, integrates into system and sells at a 50% gross margin overall. Meaning that the £1,200 manufacturing components sells for several thousand resulting in a 3-5x markup.

This happens in every component. Removing this process, could result in a 5x or more cost reduction comfortably. Vertical integration, volume manufacturing and potentially selling at a loss due to value in real time metabolomic database may allow for MS machines to be purchased at £10,000. Disruptive technologies that allow for reduced costs could happen but are more unlikely than focusing a team on a specific prototype.

Who are the smaller players research groups and companies?

For now I aim to keep an eye on developments from research groups, companies and governments who are supporting mass spectrometry.

Researchers

Girguis group Havard, underwater quadrupole $15,000

MIT 3D printed quadrupole technology (link)

Current lunar missions have requirements for small low energy mass spectrometry systems. An ion trap device is being developed by Simeon Barber at the Open university in Milton Keynes. This device is around 1.6 kg, the size of half of a shoebox and uses as much electricity as a phone charger. (link, link)

Companies

PURSPEC Technology

Owlstone medical

MOBILion

Microsaic

BaySpec

908 Devices

Component Specialists:

Creare Inc.: Miniature vacuum pumps (500g, <18W, 10⁻⁸ torr)

Ardara Technologies: RF and ion optics components

CTEC: Custom ion sources and vacuum components

Chinese Manufacturers (emerging):

Skyray Instrument: Analytical instruments including portable MS

Focused Photonics: Process MS systems

Shanghai AIPU: MS components and systems

Conclusion

As Zheng Ouyany noted. Major instrument companies are unlikely to pursue this path as it is not within their business interests. This creates a massive opportunity for startups and new entrants especially in China where patent barriers are lower, they have manufacturing expertise, government support and a growing domestic market justifying investment.

Comments